Breaking news @ 11am September 29

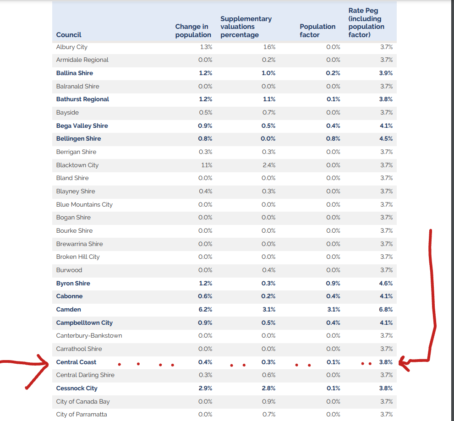

The Independent Pricing and Regulatory Tribunal (IPART) has set the rate price increase that Central Coast Council can charge next financial year at 3.8 per cent.

The news came out today at 10am.

The Council doesn’t have to Increase our rates by that much, but nor can it charge any more.

That is a decision for the Administrator and he formally makes that decision at a Council-under-administration meeting, probably at the next Council meeting on October 11.

The staff will write a report and offer a recommendation for Mr Hart to consider.

When IPART first allowed the council in 2021-2022 to increase rates by a one-off increase of 13 per cent to stay in the rates for three years, it was allowed to add on the yearly rate peg.

In the first year that meant our rates increased by 15 per cent.

This financial year, 2022-23, our rates increased by one per cent as that was the rate peg set by IPART.

In May of this year, IPART approved Council’s 2022 Special Variation submission to maintain the rate increase for an additional seven years, to June 2031, a total of ten years.

The approval included an assumed annual rate peg of 2.5% from 2023-24, in accordance with the IPART Special Variation application assumptions.

Administrator Rik Hart will now have to decide if the Council will increase rates for the 2023-24 financial year by the full rate peg.

IPART set the peg for each NSW council at between 3.7% and 6.8%, depending on its population factor.

IPART says the rate is based on the change in the Local Government Cost Index (LGCI); an adjustment for changes in the superannuation guarantee; and a population factor that is specific to each council.

The increase is below the Australian Bureau of Statistics’ (ABS) year-ended Consumer Price Index (CPI) inflation rate of 5.3% to June 2022.

“The LGCI used to calculate the rate peg is the percentage change in a basket of cost components incurred by a typical council in NSW, weighted according to the 2019 cost survey of NSW councils,” IPART said.

“The rate peg reflects the sharp rise in prices in 2021-22, but only of those cost components that are measured in the LGCI.”

A key component of the rate peg was employee costs, which reflected about 38.6% of the LGCI.

“Employee costs have increased to a lesser extent than inflation as for most councils they are set by a state award,” IPART said.

“The NSW public sector wage price index rose by 2.03% in the 2021-22 financial year. Construction works – road, drains, footpaths, kerbing, bridges are also a significant component of the LGCI, contributing 22.0%.

“The road and bridges construction index rose 5.2% in the 2021-22 financial year.”

In contract, the key drivers of CPI inflation in the 2021-22 financial year – not measured in the rate peg – included:

- Housing, which reflects 25% of the CPI and rose 6.5%.

- Food and non-alcoholic beverages, which reflects 17% of the CPI and rose 6.0%.

- Furnishings, household equipment and services, which reflects 9% of the CPI and rose 5.6%.

IPART is currently reviewing the methodology it will use to set the rate peg from 2024-25 .

It has issued a discussion paper and submissions are open until November 4.