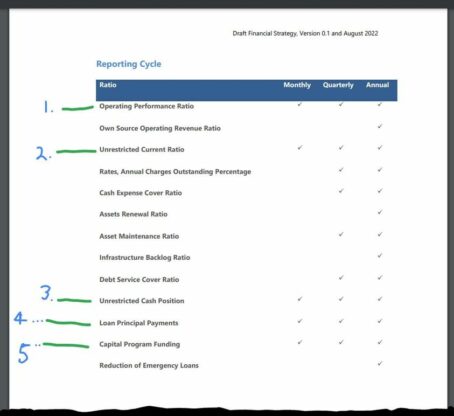

A year ago, Council-under-administration adopted a financial strategy that meant we would see five financial ratios once a month.

And we did for a while.

But at the May Council meeting we were told that the June 2023 financial report to the public would be a high-level summary report aimed at providing an initial financial position for 2022/2023 Financial Year.

No financial ratios submitted in June.

Council has to have its end of year financial statements in to the Office of Local Government by October 31.

Then we were told in June that the monthly reports of July 2023 and August 2023, would be limited to a high-level summary to allow for the completion of the 2023/2024 FY Annual Financial Statements as a priority.

No financial ratios presented in July or August.

This means we have not seen Council’s five Operating Performance Ratios since the April results presented at the May meeting.

And even then, one was missing. The Principal Loan Repayment ratio had been removed from the Table pending review.

“It is proposed to provide greater context in future reports,” Council said at the time but we haven’t seen any ratios since.

The idea behind these five measures was to give residents confidence that Council was travelling well financially.

But we haven’t seen those five measures for five months now.

As the website says: Council’s promise to the community is sound financial management and sharing information regularly about its financial position.

Back in August 23, 2022, when Administrator Rik Hart adopted the financial strategy he said the public needed to keep an eye on these five ratios. (See screenshot number two.)

As I wrote at the time: “The strategy is basically a list of 13 metrics which, if kept to, are meant to keep Council on track financially.

“Of those 13 metrics, five will be reported to the Council-under-administration monthly, with the rest reporting quarterly or yearly.

“Administrator Rik Hart said the strategy was the last piece of the jigsaw and “we” need to keep an eye on those five key metrics on a monthly basis.

“If any of them turn red, questions need to be asked immediately, he said.”

That was 12 months ago.

We don’t know if any have turned red. That’s the problem.

Two were red in the April ones we saw: the unrestricted ratio and the capital funding program.

But no advice on whether the ratios have improved or worsened since then.

The five measures are:

Operating Performance Ratio – measures Council’s achievement of containing operating expenditure within operating revenue and is set between 1% and 8%.

• Unrestricted Current Ratio – identifies whether there are sufficient funds available to meet short term obligations and is set at the industry benchmark of 1.5.

• Unrestricted Cash Position – funds available to cover operational needs and unexpected or emergency costs within each fund. Council will aim to maintain unrestricted cash in each fund and set a target band of between 3% and 10% for each fund. This monitors the targeted use of unrestricted funds on community services and infrastructure.

• Loan Principal Payments – the operating result (excluding capital grants and contributions) for each fund for the year plus pre-existing unrestricted cash reserves in each fund to at least cover the net loan principal repayments of that fund for that same year.

• Capital Program Funding – Council said its intent is to provide at least sufficient funds from operations for the capital budget to replace assets as they fall due. The depreciation target is used as a proxy for the long-term annual funding requirement to replace Council’s assets at their gross replacement value. Council will aim to achieve the industry benchmark of 100% in each fund, it said.